Introduction

In the ever-evolving landscape of the tech industry, maintaining a strong market share is crucial for any company. Samsung tablet market share in the US , Samsung is a giant in the electronics sector, has consistently made its mark. In the first quarter of 2024, Samsung was the second-biggest tablet brand in the USA, ranking just below Apple. This article delves into Samsung’s market performance, key product launches, and how it stands against its competitors.

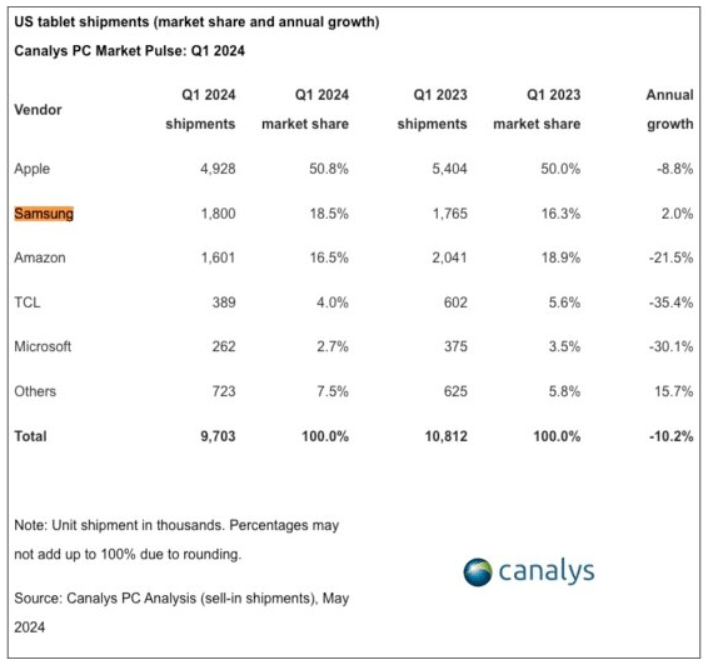

Samsung’s Market Performance in Q1 2024

Samsung showcased a solid performance in the US tablet market during Q1 2024. The company sold 1.8 million Galaxy Tab devices, securing an 18.5% market share. This was a notable increase from Q1 2023, where Samsung held a 16.3% market share with 1.76 million tablets sold. The 2% increase indicates a positive trend for the South Korean tech giant.

Key Product Launches

In the first quarter of 2024, Samsung introduced several new tablets that contributed to its market growth. The Galaxy Tab A9+, Galaxy Tab S9 FE, and Galaxy Tab S9 FE+ were among the new additions to their lineup. These products offered a range of features catering to different segments of the market. Additionally, Samsung continued to sell its high-end tablets: the Galaxy Tab S9, S9+, and S9 Ultra. These models are known for their OLED screens and flagship-grade performance, appealing to users seeking top-tier devices.

Comparison with Competitors

Apple’s Performance and Market Share

Apple maintained its dominance in the US tablet market, holding the first position with 4.92 million iPads shipped in Q1 2024. Despite this impressive figure, it was an 8.8% decline from the previous year’s 5.4 million shipments. Apple captured over half of the market share at 50.8%. The company is expected to bolster its market presence with the new iPad Pro lineup featuring Tandem OLED panels.

Amazon’s Position in the Market

Amazon targets the budget-conscious segment with its Fire tablets. In Q1 2024, Amazon shipped 1.6 million tablets, securing a 16.5% market share. However, this was a significant drop of 21.5% compared to Q1 2023. The decline highlights the challenges Amazon faces in maintaining its position amidst increasing competition.

TCL and Microsoft’s Standings

TCL experienced a tough quarter, selling just 389,000 tablets and capturing a mere 4% of the market. This was a steep decline of 35.4% from the previous year. On the other hand, Microsoft sold 262,000 Surface tablets, holding a 2.7% market share. This marked a 30.1% drop compared to Q1 2023, indicating the competitive pressures in the tablet market.

Growth Indicators for Samsung

Samsung’s growth in market share is a positive indicator. The company’s ability to increase its share by 2% shows strong consumer reception and the effectiveness of its product lineup. High-quality devices and strategic pricing have played pivotal roles in this growth.

Apple’s Market Dominance

Despite a drop in shipments, Apple remains the leader in the US tablet market. The introduction of the new iPad Pro lineup with advanced OLED panels is expected to attract more customers, potentially increasing its market share in the upcoming quarters.

Amazon’s Market Strategy

Amazon focuses on affordable tablets, catering to users who need basic devices for media consumption. While this strategy has worked in the past, the significant drop in shipments suggests that Amazon needs to innovate to stay competitive.

Challenges for TCL

TCL’s sharp decline in sales and market share underscores the difficulties the company faces. Increased competition and perhaps a lack of differentiation in their products have contributed to their struggle in the market.

Microsoft’s Position in the Market

Microsoft’s Surface tablets cater to a niche market, primarily targeting business users and professionals. The decline in shipments suggests that even this segment is feeling the heat of competition, requiring Microsoft to rethink its strategy.

Future Projections for Samsung

Looking ahead, Samsung is unlikely to launch new high-end tablets this year, following its pattern of releasing flagship models every 1.5 years. The next major release, the Galaxy Tab S10, is expected early next year. Samsung’s focus will likely remain on optimizing its current lineup and exploring new market opportunities.

Technological Advancements in Tablets

The tablet market is driven by technological advancements. Features like OLED displays, enhanced processing power, and improved battery life are becoming standard. These innovations influence consumer preferences and drive market trends.

Market Dynamics and Consumer Behavior

Understanding market dynamics is crucial for any tech company. Factors such as pricing, product quality, and brand loyalty play significant roles in consumer purchasing decisions. Samsung’s ability to navigate these factors will determine its future success.

Samsung’s Strategic Moves

Samsung’s marketing strategies and partnerships are key to its market performance. Collaborations with other tech companies and aggressive marketing campaigns can enhance its market presence and attract more customers.

Challenges Ahead for Samsung

Despite its strong performance, Samsung faces challenges from competitors like Apple and Amazon. The market’s saturation and the constant need for innovation present hurdles that Samsung must overcome to maintain its position.

Conclusion

Samsung’s position as the second-biggest tablet brand in the USA in Q1 2024 highlights its strong market presence and growth potential. While it lags behind Apple, the increase in market share and successful product launches are promising signs. The future looks bright for Samsung, provided it continues to innovate and adapt to market dynamics.

FAQs

What is Samsung tablet market share in the US ?

Samsung holds an 18.5% market share in the US tablet market as of Q1 2024.

How did Samsung perform compared to Apple in Q1 2024?

Samsung was the second-biggest tablet brand, while Apple maintained the top position with a 50.8% market share.

What are the key factors behind Samsung tablet market share increase?

Samsung’s market share increase is attributed to successful product launches, high-quality devices, and effective marketing strategies.

Which new products did Samsung launch in Q1 2024?

Samsung launched the Galaxy Tab A9+, Galaxy Tab S9 FE, and Galaxy Tab S9 FE+ in Q1 2024.

What are the future prospects for Samsung in the US tablet market?

Samsung is expected to continue its growth trajectory with future product launches and strategic market moves, maintaining its strong market position.